Sugar is everywhere. It is in drinks, desserts, sauces, and baked goods. It is also a major ingredient in global food production. Yet sugar prices and availability change often. Weather, trade rules, health trends, and supply chains all play a role. These changes can confuse businesses and consumers alike.

That is why the idea of a Sugar Volatility Fund is useful. This is not a real financial product. It is a smart way to think about how to manage changes in sweetener prices and supply. It helps food makers, bakers, and buyers stay calm and prepared when the market shifts.

In this blog, we will explain what sugar volatility means, why it happens, and how a Sugar Volatility Fund mindset helps manage sweetener market fluctuations. The language is simple. The sentences are short. The ideas are easy to use.

What Is Sugar Volatility?

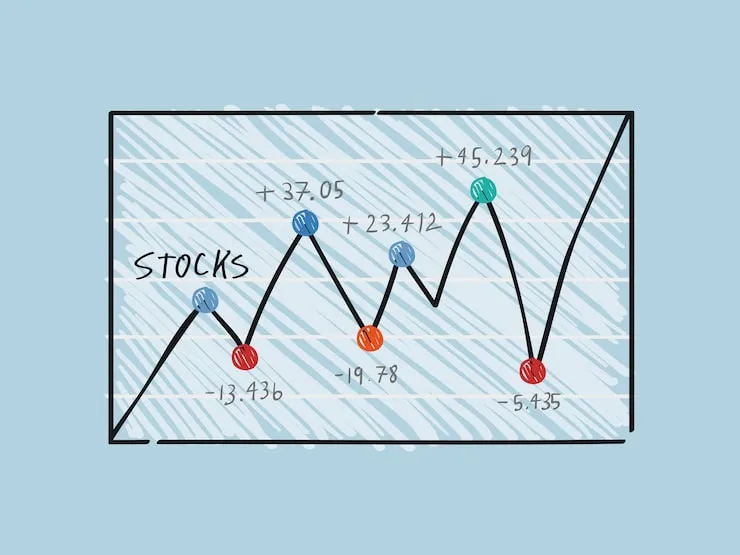

Sugar volatility means frequent changes in sugar prices and supply. Prices can rise fast. They can also fall suddenly. These shifts affect many industries.

Volatility is caused by:

-

Weather problems

-

Crop diseases

-

Trade policies

-

Fuel costs

-

Consumer demand

When sugar becomes expensive or scarce, businesses feel pressure. Planning becomes harder. Costs rise quickly.

What Is a Sugar Volatility Fund?

A Sugar Volatility Fund is a planning strategy. It spreads risk across different sweeteners and suppliers. Instead of relying on one sugar source, you diversify.

This mindset includes:

-

Using multiple sweeteners

-

Sourcing from different suppliers

-

Adjusting recipes when needed

-

Planning ahead for price changes

This approach helps reduce stress when the sugar market changes.

Why Sugar Prices Change So Often?

Sugar is a global commodity. That means it is traded worldwide. Many factors influence its price.

Weather Impact

Sugar comes from sugarcane and sugar beets. Both depend on weather. Floods, droughts, and storms reduce supply. Less supply means higher prices.

Transportation and Fuel Costs

Sugar travels long distances. When fuel prices rise, transport costs increase. These costs are passed on to buyers.

Trade Rules and Taxes

Tariffs and trade limits affect imports and exports. A small policy change can affect prices quickly.

Health Trends

When people reduce sugar intake, demand changes. At the same time, demand for alternatives increases. This shifts the market.

How Volatility Affects Businesses?

Sugar volatility hits businesses in many ways.

Effects include:

-

Higher ingredient costs

-

Reduced profit margins

-

Recipe changes

-

Pricing pressure

Small businesses feel it most. They have less room to absorb sudden cost increases. A Sugar Volatility Fund mindset helps them stay flexible.

Diversification Is the Core Strategy

Diversification reduces risk. It works in finance. It works in food.

In sweeteners, diversification means:

-

Using cane sugar and beet sugar

-

Exploring honey or maple syrup

-

Testing stevia or monk fruit

-

Adjusting sweetness levels

No single sweetener controls your outcome. That is the strength of this approach.

Understanding Alternative Sweeteners

Alternative sweeteners help balance sugar risk. Each has strengths and limits.

Honey

-

Natural

-

Adds flavor

-

Price can also fluctuate

Maple Syrup

-

Rich taste

-

Seasonal supply

-

Higher cost

Stevia

-

Very sweet

-

Used in small amounts

-

Taste varies

Monk Fruit

-

Natural

-

No calories

-

Often blended

Using several options supports the Sugar Volatility Fund idea.

Recipe Flexibility Matters

Rigid recipes increase risk. Flexible recipes reduce it.

Smart recipe planning includes:

-

Adjustable sweetness levels

-

Blends of sweeteners

-

Testing alternatives in advance

When sugar prices rise, you already have options ready.

Supplier Diversification Reduces Risk

Relying on one supplier is risky. A delay or price increase affects everything.

A better approach:

-

Work with multiple suppliers

-

Source locally when possible

-

Monitor supplier reliability

This strategy is part of managing sweetener market fluctuations.

Forecasting and Planning Ahead

Good planning reduces surprise. Tracking trends helps.

Helpful actions:

-

Watch commodity reports

-

Track past price patterns

-

Build small reserves

Even basic awareness improves decision-making.

Cost Control Through Portion Awareness

Sweetness does not always need more sugar. Sometimes it needs balance.

Ways to reduce sugar use:

-

Enhance flavor with spices

-

Use acids like citrus

-

Adjust texture and temperature

These changes reduce dependence on sugar without harming taste.

Consumer Communication Is Important

Price changes affect customers. Clear communication builds trust.

Helpful steps:

-

Explain ingredient changes

-

Highlight quality and care

-

Be transparent about pricing

Honesty reduces frustration and builds loyalty.

Sustainability and Sugar Volatility

Sustainable farming affects supply stability. Ethical sourcing supports long-term balance.

Benefits include:

-

More stable crops

-

Better soil health

-

Long-term supplier relationships

Sustainability supports the goals of a Sugar Volatility Fund.

Managing Volatility for Home Bakers

Home bakers feel sugar changes too. Prices affect grocery bills.

Helpful tips:

-

Buy sugar in bulk when prices are low

-

Store properly to avoid waste

-

Experiment with alternative sweeteners

These steps help households adapt easily.

Technology and the Sugar Market

Technology helps track and manage volatility.

Examples include:

-

Market tracking tools

-

Inventory software

-

Recipe scaling systems

Even small businesses can use simple tools to stay informed.

Why the Sugar Volatility Fund Mindset Works?

This mindset works because it focuses on control. You cannot control the market. You can control your response.

It helps by:

-

Reducing dependence on one ingredient

-

Increasing flexibility

-

Improving confidence

Prepared businesses handle change better.

Common Mistakes to Avoid

Avoid these common errors:

-

Ignoring market trends

-

Overreacting to short-term changes

-

Switching sweeteners without testing

Balance and planning matter more than quick reactions.

Teaching Teams About Volatility

Teams should understand why changes happen.

Training helps:

-

Reduce resistance to change

-

Improve creativity

-

Support teamwork

Knowledge builds confidence at every level.

Long-Term Benefits of Smart Planning

Over time, this strategy pays off.

Benefits include:

-

Stable costs

-

Fewer surprises

-

Stronger supplier relationships

This is the long-term value of a Sugar Volatility Fund approach.

Real-World Examples

Many food companies already do this:

-

Soda brands adjust formulas

-

Bakeries blend sweeteners

-

Snack companies reduce sugar levels

They adapt quietly and successfully.

Final Thoughts

Sugar volatility is real. It affects everyone from farmers to families. Prices rise and fall. Supply shifts. Trends change.

The Sugar Volatility Fund is a simple and smart way to manage these changes. It encourages diversification, flexibility, and planning. It reduces stress and protects quality.

By understanding sweetener market fluctuations and preparing for them, you stay in control. You make better decisions. You protect your business or home kitchen.

In a changing world, flexibility is the sweetest advantage of all.